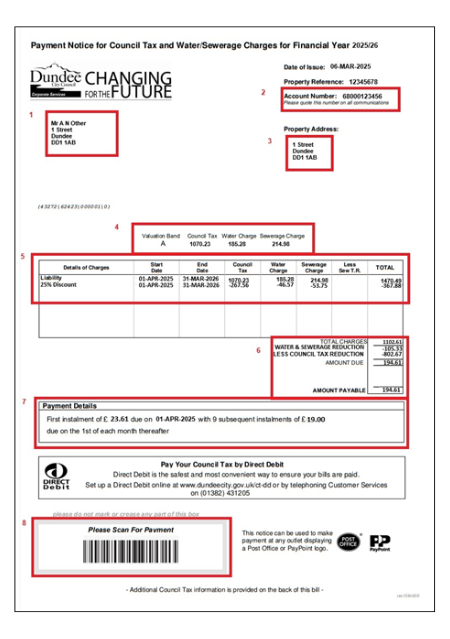

Your name and address

Your name and address- Your account number. This is the number you need if you are making payments online or on the telephone. You will also need your account number to register for the online service.

- This is the address of the property that the bill relates to.

- Your property band and a breakdown of the total charge.

Further information about Council Tax Bands are available on this website - Details of your bill. Any discounts or exemptions you are entitled to will also be shown here.

- A summary of your bill.

Total Charges - This is the amount due after any discounts, but before any Council Tax Reduction.

If you are in receipt of Council Tax Reduction it will be detailed in this section (this can be applied for if you are on a low income).

Amount Due - This is the total amount you need to pay. - Payment details.

Payments are normally due on the 1st of the month from April to January but other payment options are available. If you wish to change the date or frequency of payments, please complete our online form.

If you pay by Direct Debit, it will be shown here. Direct Debits will automatically transfer to the new tax year. - Payment barcode. This can be used to pay at any PayPoint or Post Office.

Your Council Tax Bill Explained

Was This Useful?